Skip to content

A Private Health Services Plan (PHSP) provides affordable, comprehensive, tax-free health benefit coverage to employers and employees while offering a 100% tax deductible expense to the business!

PHSP value proposition for employers (Plan Owners)

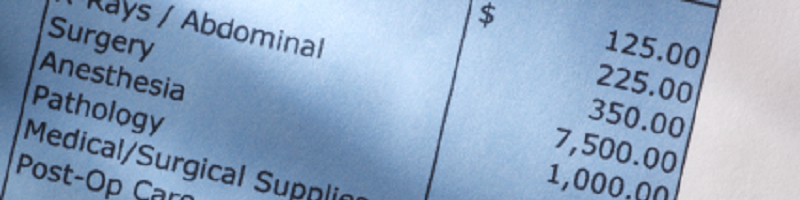

- Reduce business tax liability by making all eligible medical expenses and associated administrative costs 100% tax deductible

- Reduce business cost for providing health benefits to employees while making the coverage effective immediately and more comprehensive than traditional health insurance plans

- Monitor and control costs for employee health benefits

- Offer hassle-free, broad coverage health benefits as an added incentive to attract and retain quality employees

PHSP value proposition for employees (Plan Members)

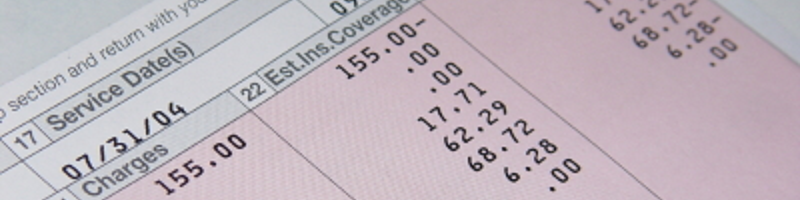

- 100% reimbursement for all eligible medical expenses, such as dental, vision and prescription drugs (see Coverage for a comprehensive list of qualified and non-qualified medical practitioners as well as eligible and ineligible expenses)

- No medical examination required for acceptance or waiting periods before you can claim for any eligible medical expense

- No personal tax liability, since reimbursements for medical expenses via a PHSP are not a taxable benefit to the employee

- No monthly premiums by comparison to traditional health benefit plans, such as those offered by Blue Cross, Manulife Financial, Sun Life and Great-West Life